As if current supply chain disruptions are not enough of a challenge for shippers, ongoing West Coast Labor Contract negotiations between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU) pose a looming threat. The labor contracts, set to expire on June 30, 2022, could potentially shut down or significantly delay shipping into the western US and other key ports.

The last major dispute between the PMA and ILWU led to a large-scale slowdown for months in late 2014 and 2015 and multiple full halts in operations at the 30 West Coast ports that have faced significant backlogs and delays throughout the COVID-19 pandemic. These ports remain critical entry points for billions of dollars of Asia-North American trade and shippers continue to prepare for what to expect in coming months if a strike were to occur again.

Historical data is a critical part of our platform. To power FourKites’ Dynamic ETA, we consider both past and current delays as part of the algorithm and provide recommendations and updated ETAs to customers. To see the potential impact to shippers on ocean or barge shipments, as either the main transit method or as part of a multimodal journey, we have examined two recent, high-profile, multi-day, port strikes that may serve as potential analogs for what shippers could expect: The Port of Montreal experienced work slowdowns and full shutdowns in August 2020 and April 2021, while the Ports of Australia — specifically Melbourne, Sydney, and Fremantle in this analysis — experienced high profile slowdowns and shutdowns for much of the second half of 2021. Overall we found that the labor disputes led to significant short and long term effects at all of the affected ports.

For purposes of this analysis, “During” refers to the time periods of the actual strikes, “Before” refers to 6 weeks prior to initial work slowdown/stoppages, and “After” refers to 6 weeks following labor resolution. Loads analyzed included any Ocean/Barge Shipments with either pickup or delivery at the Ports of Montreal, Melbourne, Sydney, and Fremantle during the analyzed periods.

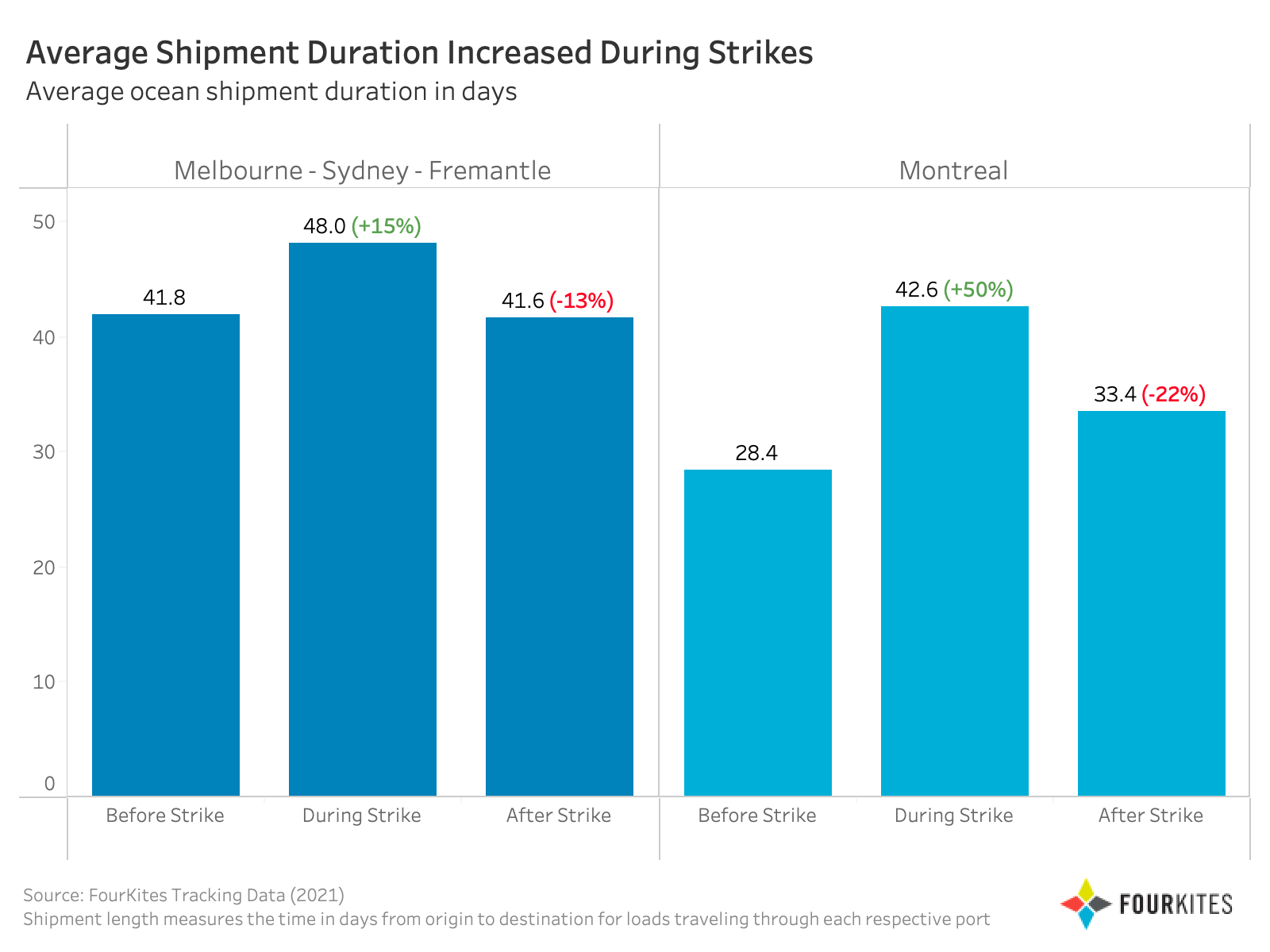

The average length of shipments involving any of the 3 Australian Ports increased significantly during the strike periods, increasing total shipment length by approximately 15% – to 48 days. In Montreal, the total shipment length increased by an average of 50% over the period before the strike and approximately 9% over the period after labor resolution. The strike did not appear to cause a significant additional backlog delay for shipments passing through the affected Australian ports following the resolution and the port was able to revert back to normal speeds rather efficiently. This was not the case in Montreal, as average shipment lengths remained elevated for approximately three months following resolution. Shipments that passed through the Port of Montreal remained significantly delayed through their final destinations.

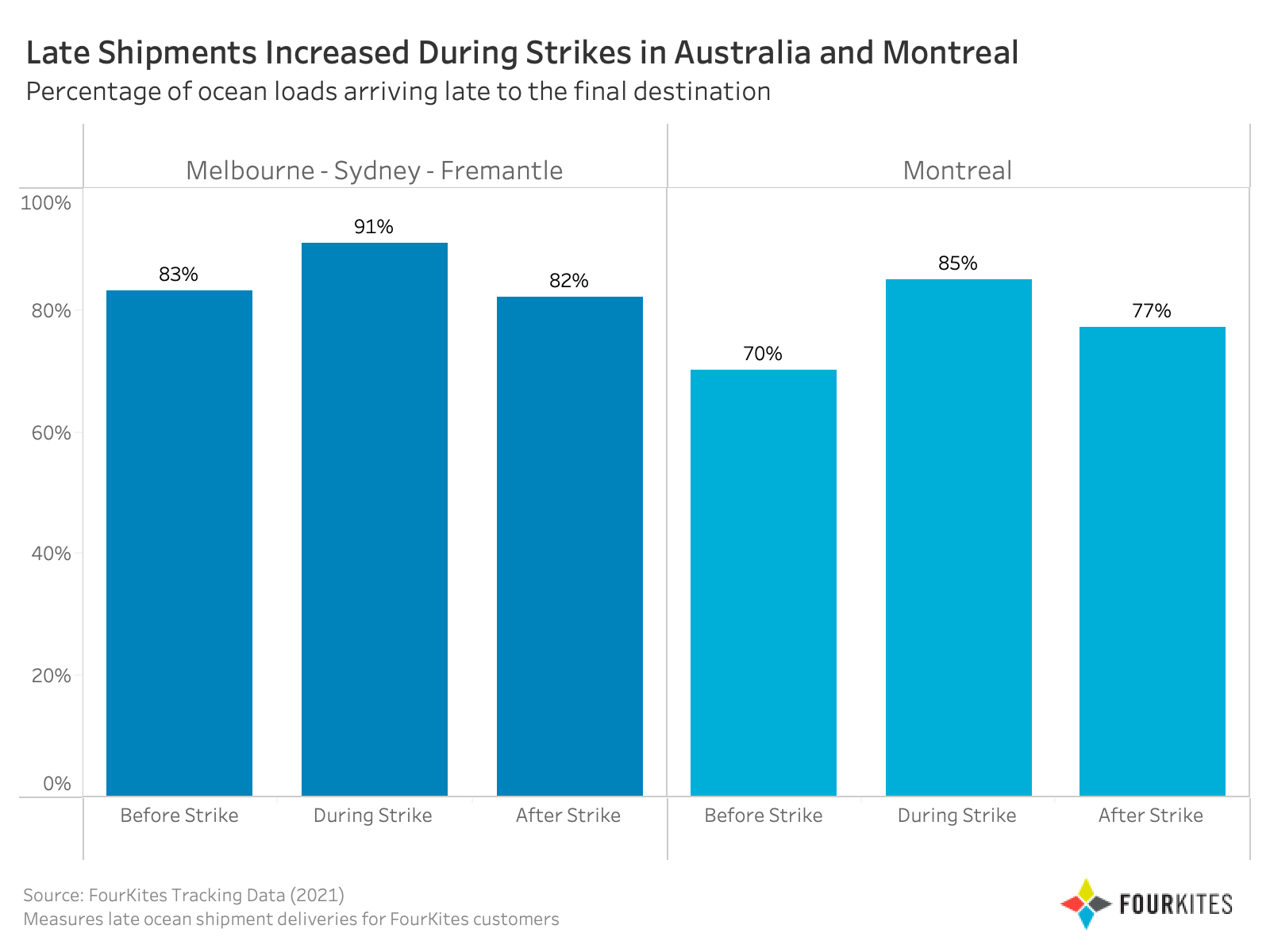

A similar trend occurs in the percentage of shipments that arrived late to the final destination. For those shipments passing through the Australian ports, shipments arriving late spiked by approximately 9% and then returned to normal levels following resolution. For those passing through Montreal, the strike periods saw the percentages of overall shipments arriving late increase by approximately 21%, and then remained 9% above normal operational levels for multiple months. With at least an additional 9% of loads arriving late, shippers were increasingly left wondering when their shipment would arrive, without necessary stock, or needing to expedite other shipments to meet plans and goals.

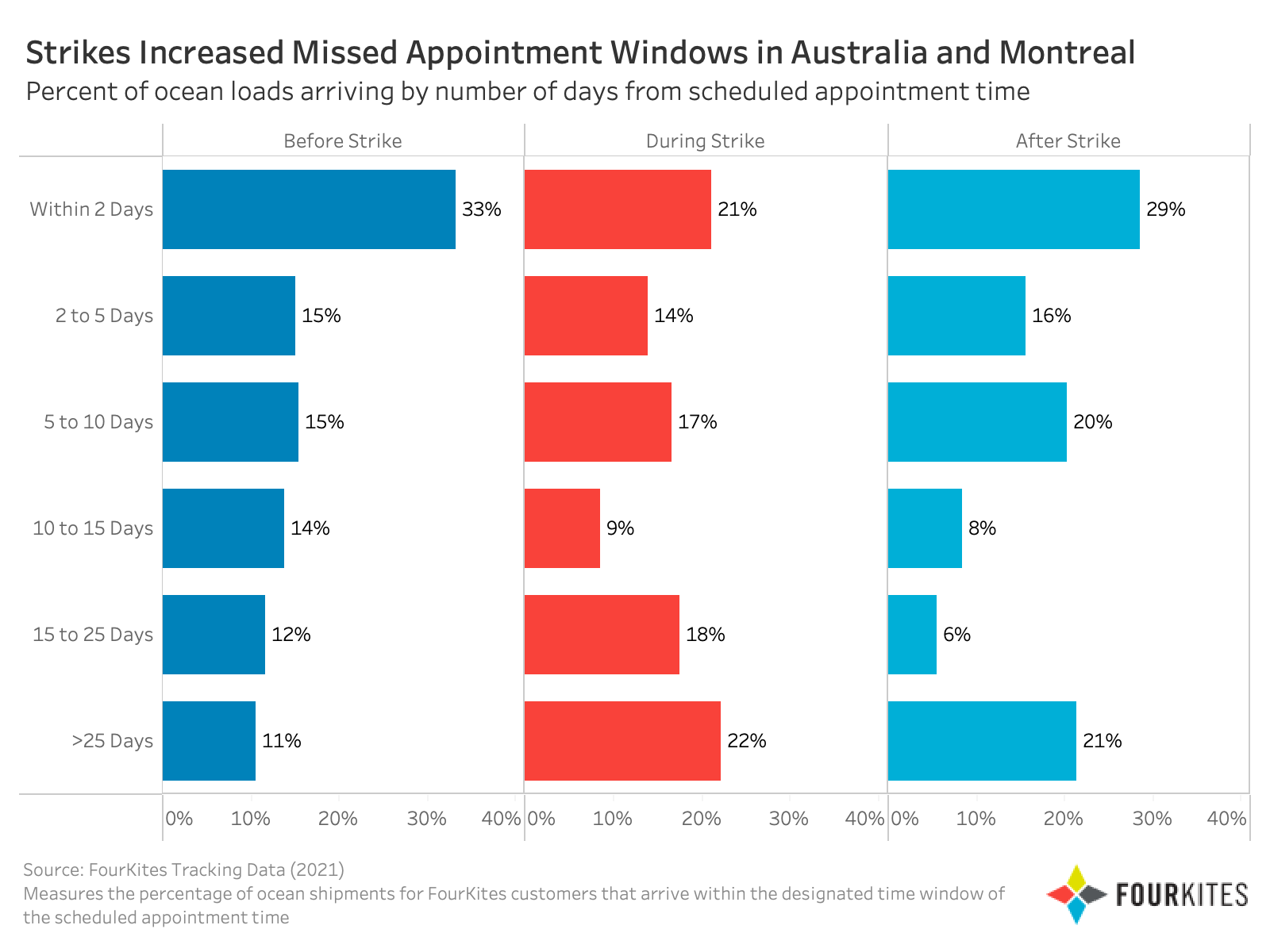

Appointment Time Error

The below tables show the rate at which downstream appointment times set by shippers without the use of machine learning algorithms are increasingly unreliable at predicting actual Port of Delivery arrivals at ports during labor disputes. For example, while the dispute occurred in Australia, appointment times were within 2 days of actual arrival time at the 3 Australian ports only 17.9% of the time. In both instances, the strikes resulted in a significant decrease in the reliability of appointment times on those shipments occurring during the strike periods, and slight to significant decreases in reliability of appointment times in the period following the dispute resolution as those that originated at the affected ports reached their final destinations.

FourKites ETAs help customers close this visibility gap under both complex and normal supply chain conditions by identifying when appointment times will be missed and providing the most accurate predictions of actual time of arrival as early as possible.

How to build a resilient supply chain for 2022 labor disruptions

What is clear from these trends is that disruptions make significant impacts to carrier ETAs, dwell time and even the full multimodal journey with the port delays and closures. With shippers aware of potential disruptions happening this summer on the West Coast, we recommend the following for increased resiliency to your supply chain:

Build a faster workflow

Leave manual processes behind when it comes to tracking your ocean shipments. During times of disruption, whether it is port congestion, vessel delays or labor strikes, shippers need a more effective – and resilient – workflow for knowing where their containers are in real time and if they are impacted by disruptions. End-to-End supply chain visibility allows shippers to know in real-time where their containers are, without the back and forth emails and phone calls, along with accurate predictive ETAs across the entire container’s multimodal journey and proactive exception management. ETAs and milestones from carriers are notoriously inaccurate and slow to update. Shippers should look for predictive ETAs, like FourKites’ Dynamic ETA, to provide more accurate and timely information on where their containers are and when they will arrive. FourKites Dynamic ETAs alert shippers of delays approximately 2.5 times sooner than the average ocean carrier.

Proactive, not reactive customer communication

Shippers should effectively communicate with downstream stakeholders and proactively solve for the uncertainty caused when containers are late. This provides shippers with significant time to “firefight exceptions“ and reorganize planned operations. When this occurs, instead of leaving stakeholders in the dark with consistently reactive decision-making, predictive ETAs ensure stakeholders are proactively informed of current situations, minimizing the impacts of strikes and other exceptions and can better utilize operational and downstream workforce planning.

Analyze historical performance

While labor strikes are not preventable from the shipper’s point of view, there are ways to mitigate the disruption to your supply chain. One key area is analyzing the historical performance of your frequently used ocean carriers, lanes and ports. By looking at this historical data, you can see the worst (or best) offenders, where you can mitigate some of the delays in the future and areas to optimize your supply chain from future disruptions.

For more information on how FourKites can help provide shippers with ocean visibility and achieve supply chain resiliency, go to www.FourKites.com.